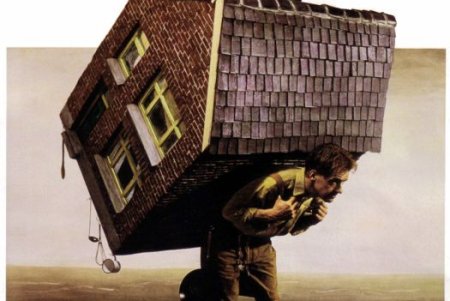

At the request of a Milk Your Money subscriber, we are doing a two part series on the pros and cons of refinancing your loans in light of the Federal Reserves recent interest rate cuts. Today, we will focus on refinancing your home loan. Should you take advantage of the rate cuts and refinance your home? Tomorrow, we will do a piece on what the rates cuts mean to both your student loans, what actions should you take? Click here to subscribe to Milk Your Money’s daily posts in your email, so you don’t miss out on tomorrow’s follow-up piece.

At the request of a Milk Your Money subscriber, we are doing a two part series on the pros and cons of refinancing your loans in light of the Federal Reserves recent interest rate cuts. Today, we will focus on refinancing your home loan. Should you take advantage of the rate cuts and refinance your home? Tomorrow, we will do a piece on what the rates cuts mean to both your student loans, what actions should you take? Click here to subscribe to Milk Your Money’s daily posts in your email, so you don’t miss out on tomorrow’s follow-up piece.What are your Plans?

Do you plan to pay off your mortgage in full? Will you be living in your home for at least another three years? Do you want to pay off your mortgage faster? These are all legitimate questions you should ask yourself before refinancing your mortgage.

It’s important to understand that when you refinance your home with a lower interest rate, the reduction to your monthly payments will not be dramatic, thus the number of monthly payments you intend to make at your reduced rate should equal a higher figure than the fees associated with refinancing. In other words, most banks will charge on average around 2% of the entire new loan in closing cost (similar to the fees you paid when you closed your first home loan). As an example, if you refinance your current home at $200,000 with a savings of $85/month due to the reduced interest rate, you must live in your house for at least 4 years to equal the $4,000 (2% of loan in closing costs) to start benefiting from the refinance. You can now find different refinance packages that will offer lower costs to close as well as no costs, but these packages general come with higher rates. What we can gather from this is, if you do not plan on living in your house for years to come it is most likely not beneficial for you to refinance.

If you are lucky and have some extra money to pay off your loan faster, you can refinance your home at the lower interest rates to switch your loan to lets say a 15-year fixed loan. This will allow you to have slightly higher monthly payments but will save you thousands in long-term interest due to the shorter loan term and the reduced rate. This is highly recommended when affordable.

Do You Currently have an Adjustable Rate Mortgage (ARM)

ARM home loans - which have caused our current credit crisis – are loans where your interest rate will readjust to higher rates due the terms in your current loan, which increases your monthly payments, unlike a 30-year fixed loan. If you currently have an ARM loan on your home and your rate is set to increase in the near future, refinancing your mortgage is probably a great idea. The benefits to this are two fold. First, you can avoid higher monthly mortgage payments by refinancing to the current lower rates and pay off more of your principal with each payment. Second, by refinancing your ARM loan to a fixed term loan, you can rest assured that you can continue to afford you mortgage, which is piece of mind that does not have a price tag.

Do You Own at Least 20% of Your Home?

Private Mortgage Insurance (PMI) is added to your monthly payment if y

ou do not own at least 20% of your home. PMI payments can range anywhere from $100/month - $300/month depending on the size of your loan. Many of you may have piggyback loans, which are loans of two amounts typically one loan for 80% and another for 20% (this loan will most likely have a higher rate and separate terms), this type of borrowing allows you to bypass paying PMI. You may want to consider refinancing your loan if you have a piggyback product if the value of your home combined with your previous principal payments, gives you 20% ownership of your home. This will allow you to cash in on the lower rates as well as combine your loan into one fixed rate loan with no PMI, a win win situation.

ou do not own at least 20% of your home. PMI payments can range anywhere from $100/month - $300/month depending on the size of your loan. Many of you may have piggyback loans, which are loans of two amounts typically one loan for 80% and another for 20% (this loan will most likely have a higher rate and separate terms), this type of borrowing allows you to bypass paying PMI. You may want to consider refinancing your loan if you have a piggyback product if the value of your home combined with your previous principal payments, gives you 20% ownership of your home. This will allow you to cash in on the lower rates as well as combine your loan into one fixed rate loan with no PMI, a win win situation.Conclusion

Take all of the above into account when considering refinancing your home and remember to look beyond your current lender when you are shopping for interest rates. Other lenders may be able to offer you lower rates in addition to reduced closing costs.

Check back tomorrow when we discuss what the rate cuts mean to your student loans. $

1 comment:

yep, I own almost 100% of it. Only $920 to go till I am mortgage free.

Post a Comment